Description

In this online engineering PDH course, the feasibility of using Vehicle Mileage (VM) fees as a funding mechanism to meet long-term transportation needs is discussed. Transportation officials are becoming increasingly concerned about the fuel tax’s ability to continue funding transportation development adequately. As currently applied, the tax generates revenue in proportion to fuel consumption, not actual road use. But as vehicles become more fuel efficient, revenue per mile traveled decreases, and the fuel tax’s ability to fund infrastructure development is in doubt. VM fees, on the other hand, offer an income stream that is independent of vehicle fuel efficiency and grows directly with road use. This course a) presents the case for pursuing VM fees, b) describes the obstacles that may prevent the implementation of such fees, and c) discusses the idea of a trial deployment of vehicle mileage fees, focusing entirely on fully electric vehicles that will soon appear on the market. This vehicle class represents a small percent of the vehicle fleet and would constitute a class of vehicles that falls outside the existing fuel tax collection system and hence pay no direct road user fees except vehicle registration.

The course is based on a study of the possibility of introducing VM fees in the State of Texas, but the study findings are generally applicable to other jurisdictions as well.

This course is based on the document, “Exploratory Study: Vehicle Mileage Fees in Texas,” written by Richard Baker and Ginger Goodin, August, 2010 (published January, 2011), Report No. FHWA/TX-11/0-6660-1 of the Texas Transportation Institute, as part of a project performed in cooperation with the Texas Department of Transportation and the Federal Highway Administration.

- Domestic studies

- International applications

- Technology issues

- Administrative issues

- Public acceptance

- Odometer reading-based model

- Cellular/Zone-based model

- GPS-based facility specific model

- Potential applications of vehicle mileage fees

- Addressing public acceptance barriers

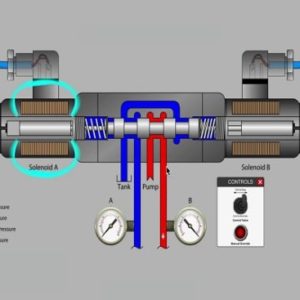

E 1102 Valve Fundamentals

2 × $100.00

E 1102 Valve Fundamentals

2 × $100.00  E - 1823 Fluid Power (Part 3) – Hydraulic Components

1 × $150.00

E - 1823 Fluid Power (Part 3) – Hydraulic Components

1 × $150.00  E - 1114 Hydraulic Jumps and Supercritical & Non-uniform Flow

1 × $75.00

E - 1114 Hydraulic Jumps and Supercritical & Non-uniform Flow

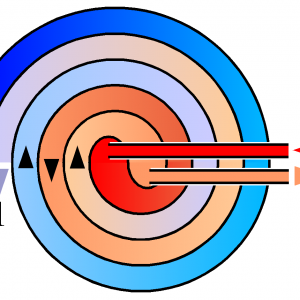

1 × $75.00  E - 1106 Fundamentals of Heat Exchangers

1 × $50.00

E - 1106 Fundamentals of Heat Exchangers

1 × $50.00  E - 1765 Advanced Storm Water Design

1 × $150.00

E - 1765 Advanced Storm Water Design

1 × $150.00

E 1102 Valve Fundamentals

E 1102 Valve Fundamentals  E - 1823 Fluid Power (Part 3) – Hydraulic Components

E - 1823 Fluid Power (Part 3) – Hydraulic Components  E - 1114 Hydraulic Jumps and Supercritical & Non-uniform Flow

E - 1114 Hydraulic Jumps and Supercritical & Non-uniform Flow  E - 1106 Fundamentals of Heat Exchangers

E - 1106 Fundamentals of Heat Exchangers  E - 1765 Advanced Storm Water Design

E - 1765 Advanced Storm Water Design